Corporate Governance

Corporate Governance

Basic Approach to Corporate Governance

Through the provision of human resource services and DX services, and by working to solve various problems in the labor market, dip aims to realize a society in which everyone can experience the joy and happiness of work, based on a vision of becoming a “Labor force solution company” under the corporate philosophy of “tapping into dreams, ideas and passion to create a better society.”

Ensuring effective corporate governance is essential to realizing this vision. Under an appropriate corporate governance system, we aim to increase medium and long-term corporate value while fulfilling our responsibilities to all stakeholders by enhancing management transparency and conducting efficient corporate operations.

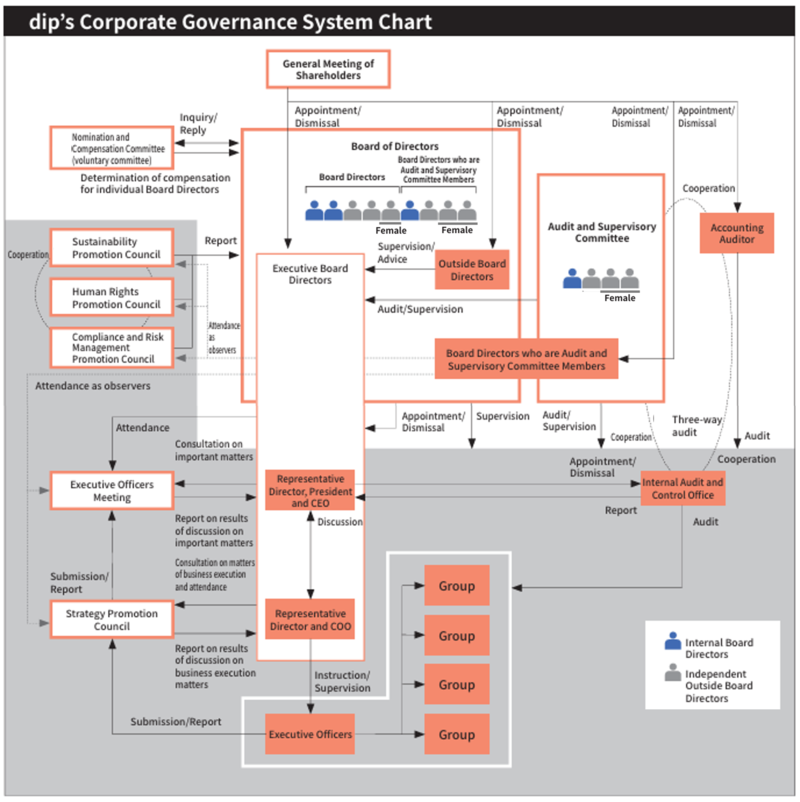

dip has transitioned from a company with an Audit & Supervisory Board to a company with an Audit & Supervisory Committee with the resolution of the 26th Annual General Meeting of Shareholders held on May 24, 2023. Its aim is to strengthen the auditing and supervision of executive directors and further enhance its system of corporate governance by making Audit & Supervisory Committee members, who are responsible for auditing the execution of duties by board directors, members of the Board of Directors.

dip is determined to continue its efforts to pursue healthy and transparent corporate management and further improve and enhance its corporate governance in the future.

Corporate Governance Report 2025/11/14

Organizational structure

(1) Board of Directors

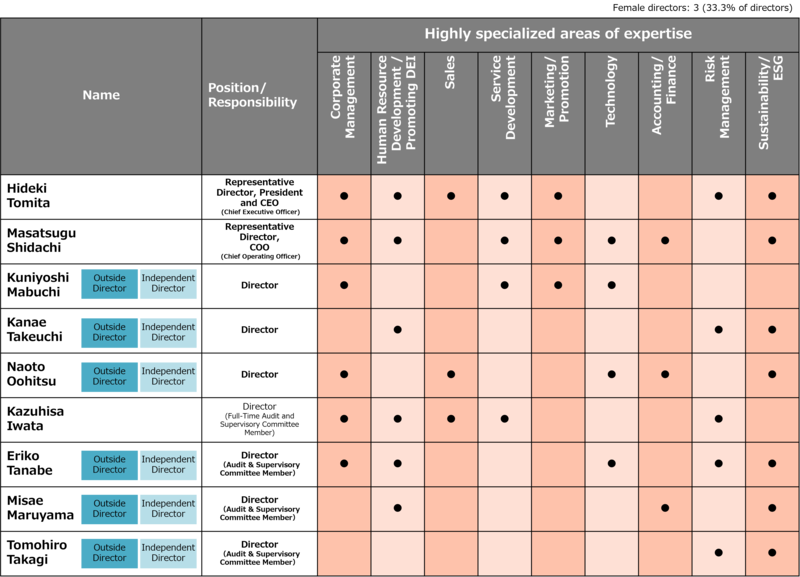

The Board of Directors, which is the management decision-making organ, consists of nine directors who possess a high degree of expertise and broad knowledge based on extensive experience. Board meetings are held on a monthly basis, in principle, and extraordinary Board meetings are held when needed to discuss and decide important management matters. Furthermore, based on the basic policy of having approximately two-thirds of the Board of Directors be independent outside directors and aiming for half of the directors to be female, six of the nine directors are outside directors. By having outside directors who are independent of the management team and controlling shareholders account for approximately two-thirds of the Board of Directors, we seek to strengthen its supervisory function over management.

Chairperson: Hideki Tomita, Representative Director, President and CEO

Board members: Masatsugu Shidachi, Representative Director and COO, Kuniyoshi Mabuchi, Kanae Takeuchi, and Naoto Oohitsu, Outside Directors; Kazuhisa Iwata, Director and Full-time Audit & Supervisory Committee Board Member; and Eriko Tanabe, Misae Maruyama and Tomohiro Takagi, Outside Director Audit & Supervisory Committee Members

(2) Audit & Supervisory Committee

The Audit & Supervisory Committee consists of four members with a high level of expertise and a wide range of knowledge, three of whom are Outside Directors in addition to their roles on the Audit & Supervisory Committee. Committee meetings are held on a monthly basis, in principle, and extraordinary Committee meetings are held when needed. The Audit & Supervisory Committee discusses matters stipulated by law and the Articles of Incorporation, conducts significant audit operations in accordance with the audit policy set forth by the Committee and strives to enhance the system for audit and supervision. Board directors who are Audit & Supervisory Committee members attend important meetings, such as Board meetings, to audit the legality and supervise the adequacy of board directors’ execution of duties.

Chairperson: Kazuhisa Iwata, Director and Full-time Audit & Supervisory Committee Board Member

Committee members: Eriko Tanabe, Misae Maruyama and Tomohiro Takagi, Outside Director Audit & Supervisory Committee Members

(3) Voluntary Nomination and Compensation Committee

The Nomination and Compensation Committee, a voluntary advisory body to the Board of Directors, deliberates and reports on matters related to director nominations and compensation in response to inquiries from the Board of Directors.

The Committee comprises the representative director, president and CEO and independent outside board directors. The latter must account for a majority of the Committee members, and the Committee must be chaired by an independent outside board director.

Chairperson: Kuniyoshi Mabuchi, Independent Outside Director

Committee members: Hideki Tomita, Representative Director, President and CEO; Kanae Takeuchi and Naoto Oohitsu, Independent Outside Directors; and Eriko Tanabe, Misae Maruyama, and Tomohiro Takagi, Independent Outside Director Audit & Supervisory Committee Members

(4) Corporate Officers Meeting

dip has introduced a corporate officer system to expedite decision-making and ensure smooth execution and has established the Corporate Officers Meeting, which primarily comprises Representative Director, Director, Full-time Audit and Supervisory Committee Member, and corporate officers. The Corporate Officers Meeting is held every week, in principle, to share information and discuss key matters.

(5) Strategy Promotion Council

dip has established the Strategy Promotion Council, which discusses the agenda of the Corporate Officers Meeting in advance, to support swift management decision-making. It is attended by executive directors. The Strategy Promotion Council meets every week, in principle, to share information and discuss business execution matters.

Note 1: Resolutions of the Board of Directors shall be adopted by a majority of the directors present at any meeting where a majority of the directors are in attendance.

Note 2: Directors (excluding those who are members of the Audit & Supervisory Committee) shall serve a one-year term, expiring at the conclusion of the Annual General Meeting of Shareholders representing one Board Tenure Year since their election.

Note 3: Directors who are members of the Audit & Supervisory Committee shall serve a one-year term, expiring at the conclusion of the Annual General Meeting of Shareholders representing two Board Tenure Years since their election.

dip’s Corporate Governance System

Skill Matrix of Board of Directors and Audit & Supervisory Committee (Reference Material)

Notes: Mses. Kanae Takeuchi, Eriko Tanabe, and Misae Maruyama are female officers. Ms. Kanae Takeuchi is internationally minded from her many years of living abroad and through her extensive experience as a broadcaster for new programs and interviewer of corporate executives. The chart above is not necessarily a representation of all the relevant experience and expertise held by each officer.

Officer Compensation SystemDisclosure of Policy for Determining the Amount or Calculation of Compensation

(1) Basic policy

The basic policy of the compensation system for dip’s management and board directors, which excludes that for outside board directors and Audit & Supervisory Committee members who are expected to perform oversight and supervisory functions with impartiality, is to share value with shareholders, taking into consideration a sufficient level for employing and retaining competent personnel while maintaining objectivity and transparency that enable full accountability, and promote continuous growth of the Company and as well as a medium/long-term increase in its corporate value through a sound entrepreneurial spirit.

The policy for determining the amount of compensation for individual board directors is set forth under the above basic policy. The outline is as described below. Said determination policy is decided by resolution of the Board of Directors based on a report by the Nomination and Compensation Committee, an advisory body to the Board of Directors chaired by an independent outside board director and consisting of independent outside board directors in the majority.

The Board of Directors has confirmed that the method of determining compensation details, and the details of the compensation, resolved for each individual director for the fiscal year under review are consistent with such decision-making policy.

【Executive directors】

The compensation system for executive directors consists of cash compensation as the base compensation and performance-linked compensation aimed at emphasizing the link with dip’s share value and bolstering executive directors’ awareness toward contributing to medium/long-term performance and corporate value improvement.

The base compensation is determined by multiplying the base amount of the compensation of the representative director, President and CEO by a coefficient for each managerial position as prescribed by internal rules.

【Outside board directors and Audit & Supervisory Committee members】

In principle, compensation for outside board directors and Audit & Supervisory Committee members consists solely of cash compensation as the base compensation to ensure the effectiveness and impartiality of supervision and audit.

【Policy for each managerial position】

Compensation for the different managerial positions is derived by multiplying the base amount, which is the base compensation for the Representative Director, President and CEO, by a coefficient for each managerial position prescribed by internal rules. The Board of Directors entrusts the determination of the base amount and the coefficient for each managerial position to the Nomination and Compensation Committee.

(Executive Compensation Structure)

Executive Classification | Total amount of compensation by type | ||

Fixed compensation | Performance based compensation | ||

Cash compensation | Stock based compensation | ||

Base compensation | Short-term incentives | Medium to long term incentives | |

Executive Director | 〇 | 〇 | 〇 |

Non-Executive Director | 〇 | ― | ― |

(2) Policy concerning performance-linked compensation (non-cash compensation) and its percentage relative to base compensation

dip has established a BIP (Board Incentive Plan) trust and offers restricted stock to executive directors as a performance-linked compensation.

Decisions regarding the levels of performance-linked compensation, and its percentage relative to base compensation, are taken after a comprehensive review of the medium/long-term ratio of performance-linked compensation to annual compensation and the difficulty of achieving performance targets, after conducting an objective benchmark comparison that takes into account the scale of dip’s business, and utilizing a remuneration database aggregated and analyzed by a specialist external institution.

The BIP trust adopts net sales and operating income, which are dip’s key managerial indicators, at a 1:1 ratio as performance indicators. The number of shares granted ranges between 0% and 150% based on the achievement of performance targets.

The restricted stock compensation adopts net sales and operating income, which are dip’s key managerial indicators, as performance indicators. The restrictions will be lifted in accordance with the achievement of performance targets, which will be disclosed in the financial results report for the fiscal year ending February 28, 2027.

(Target and actual performance for the fiscal year under review)

The target and actual net sales and operating income used for calculating performance-linked compensation (BIP trust) are as follows:

Indicator | Target | Actual |

|---|---|---|

| Net sales (million yen) | 51,953 | 49,378 |

| Operating income (million yen) | 12,303 | 11,991 |

(3) Policy concerning the timing and conditions for granting compensation

・Timing of granting compensation

Type of compensation | Timing of payment | |

|---|---|---|

| Base compensation | Annual salary (paid monthly)/td> | |

| Performance- linked compensation | BIP trust | Upon retirement |

| Restricted share compensation | When restrictions are lifted | |

・Conditions for compensation

(BIP trust)

BRegarding the BIP trust, eligible directors who have satisfied the prescribed requirements are granted 50% of the dip shares that correspond to their stock delivery points and cash equivalent to the amount converted to cash within the trust for the remaining 50% of dip shares as said performance-linked share-based compensation.

We have established a Malus clause, which cancels the right of an eligible director to receive said performance-linked, share-based compensation in the event of a serious violation of duties or internal regulations during the term of office of the director. In addition, a clawback clause has been established, enabling the Company to demand the return of said share-based compensation if the fact of said violation is discovered after the compensation has been provided.

(Restricted stock compensation)

Enrollment conditions and performance-linked conditions are imposed on restricted stock compensation until the lifting of restrictions.

A claw back clause has been established, enabling the Company to demand the return of said restricted stock compensation in the event of a serious violation of duties or internal regulations during the term of office of the eligible director.

(4) Matters concerning the delegation of the determination of compensation

・Determination of customary remuneration for officers

dip’s policy for officers’ customary remuneration is determined by its Board of Directors in view of a report by the Nomination and Compensation Committee.

・Determination of the base compensation amount

From the perspective of improving objectivity and transparency, the base compensation is determined by the Nomination and Compensation Committee, which is entrusted by dip’s Board of Directors, within the limit of compensation established by resolution of the general meeting of shareholders, taking into consideration the officer’s managerial position (including the coefficient prescribed by internal rules), responsibilities, and contribution to business performance. The constituents of the Committee are Hideki Tomita, Representative Director, President and CEO; Kuniyoshi Mabuchi, Kanae Takeuchi, and Yuka Shimada, Independent Outside Directors; and Eriko Tanabe, Yukiko Imazu, and Misae Maruyama, Independent Outside Director Audit & Supervisory Committee Members.

・Determination of performance-linked compensation

The BIP trust is determined separately from the base compensation by resolution of the Board of Directors within the limit of resolution of the general meeting of shareholders.

The restricted stock compensation is determined separately from the base compensation by resolution of the Board of Directors within the limit of resolution of the general meeting of shareholders.

・Procedure for Determining Officer Compensation

Dates and Details of Resolutions by General Meetings of Shareholders regarding Officer Compensation

The dates and details of resolutions by General Meetings of Shareholders regarding officer compensation, etc. are as follows:

| Type of compensation | Date of resolution | Eligible persons | Amount, etc. | Number of persons eligible at time of resolution | |||

|---|---|---|---|---|---|---|---|

| Base compensation | May 24, 2023 | Board Directors (excluding Audit and Supervisory Committee Members) | 675,000 thousand yen per year (including up to 100,000 thousand yen per year for Outside Board Directors) | 5 | |||

| Base compensation | May 24, 2023 | Audit and Supervisory Committee Members | Up to 125,000 thousand yen per year | 4 | |||

| Performance-linked compensation (BIP trust) | May 24, 2023 | Board Directors (excluding Outside Board Directors and Audit and Supervisory Committee Members) | Up to 400,000 thousand yen every f ive fiscal years and up to 40,000 shares per year | 2 | |||

| Performance-linked compensation(Restricted share compensation) | May 24, 2023 | Board Directors (excluding Outside Board Directors and Audit and Supervisory Committee Members) | Up to 900,000 thousand yen and up to 350,000 shares every six fiscal years | 2 | |||

(5) Procedures of the Nomination and Compensation Committee

Entrusted by the Board of Directors, the voluntary Nomination and Compensation Committee determines individual director compensation (base amount and coefficients determined for each position) and also deliberates and reports on matters related to director nominations and compensation in response to inquiries from the Board of Directors. The Committee comprises the representative director, president and CEO and independent outside board directors, who must account for a majority.

Please refer to the Annual Securities Report for details on executive compensation.

Strengthening the Internal Control System

The Company and its subsidiaries have established the following basic policy regarding the development of an internal control system and will establish an appropriate and efficient system by constantly reviewing the administrative authority and division of duties in response to changes in the business environment and other factors. We also disclose this basic policy to the public and make efforts to promote the establishment of a more appropriate and efficient system by revising it as necessary through continuous reassessment.

Measures to revitalize the General Meeting of Shareholders and Facilitate the Exercise of Voting Rights

In order to allow as many shareholders as possible to participate, we avoid holding meetings during periods of congestion when many other companies are holding their general meetings. Our General Meeting of Shareholders is streamed in real time to allow shareholders the opportunity to participate wherever they are. We have also introduced an electronic voting platform and the ability to exercise voting rights via the Internet.

To enable shareholders to fully consider the agenda for the meeting, we send out the convocation notice at least 22 days prior to the date of the meeting and disclose the notice in Japanese and English (abridged version) on both TDnet and our corporate website. In addition, we are promoting improvements in the design and visuals of convocation notices, and on the day of the General Meeting of Shareholders, we are working to make it easier to understand the Company's business performance and business status by providing business reports using videos in addition to other materials.

Constructive Dialogue with Shareholders and Investors

Basic Philosophy

We recognize that two-way communication with our shareholders and investors, who are valued stakeholders, is essential for our sustainable growth and for the enhancement of corporate value over the medium to long term.

Based on this belief, we will strive to deepen the understanding of our shareholders and investors and build long-term relationships of trust by proactively disclosing information regarding management strategies and the business environment on our corporate website and by enhancing constructive dialogue.

Communication between Shareholders and Interlocutor

The Company's management (Representative Director ,President and CEO, Representative Director, COO, Corporate Officer, CFO Head of Corporate Management Group) will oversee all aspects of our communication with shareholders and other stakeholders, and will strive to realize constructive dialogue.

In addition, based on the wishes of shareholders and investors, other members of the management team (Outside directors, Corporate officers, etc.) and the general manager of the Investor Relations Division, will respond to requests and address the main concerns that arise from meetings.

Specific initiatives for constructive dialogue with shareholders

(1) Organic cooperation with internal divisions to support dialogue

When engaging in constructive dialogue with shareholders and investors, the division in charge of investor relations will assist the interlocutor in cooperation with other divisions to provide accurate information based on the interests of shareholders and investors. In order to promote smooth dialogue with shareholders and others, the division in charge of investor relations will hold regular meetings to collaborate and share information.

(2) Efforts to Enhance Means of Dialogue

In addition to the General Meeting of Shareholders and individual meetings, we hold financial results briefings and small meetings to explain our business status and strategies to our shareholders and investors. Furthermore, we are working to promote dialogue by actively disclosing information on our corporate website and enhancing Integrated Reports.

(3) Internal Feedback Regarding the Content of Dialogue

Opinions, requests, concerns, etc. from shareholders and investors obtained through dialogue are compiled by the Investor Relations Division and reported quarterly to internal stakeholders, including management, at meetings of the Board of Directors, Corporate Officers Meeting, and other management meetings. Matters of high importance or those requiring a prompt response are reported to the CEO, COO, and other members of the management team on a case-by-case basis, without waiting for quarterly reporting opportunities, and are addressed as appropriate.

(4) Management of Insider Information

When engaging in dialogue, we will comply with the separately stipulated "Rules for Management of Inside Information and Insider Trading" and thoroughly manage insider information in accordance with the "IR Policy".

Implementation of feedback on shareholders' and investors' opinions and concerns identified through dialogue

In the previous fiscal year, the Company actively exchanged opinions with shareholders and investors through individual interviews with overseas and domestic analysts and institutional investors, in addition to the General Meeting of Shareholders, financial results briefings (held four times a year) and small meetings. (Number of meetings during the fiscal year ended February 28, 2025: 377)

The content of the dialogues is compiled and reported quarterly to internal stakeholders, including management, at Investor concerns, comments and evaluations regarding the announcements of financial results and other matters are reported on a case-by-case basis, and are utilized in the formulation and execution of management strategies in discussions to further enhance corporate value meetings of the Board of Directors and the Corporate Officers Meeting.

In addition, during the current fiscal year, we are striving to further promote constructive dialogue by increasing opportunities for individual meetings with shareholders and investors, such as by holding a new overseas roadshow.

Items incorporated based on dialogue and subsequent feedback

Newly formulated financial strategies incorporated in the "dip30th" Mid-term Management Plan (announced in November 2023 and covering the period FY02/2025-FY02/2027) were informed through preliminary conversations between the CFO and several shareholders and investors, and further refined and decided by the Board of Directors and the Management Committee. Specifically, we aim to increase corporate and shareholder value by maximizing the equity spread, and have formulated strategies to improve ROE, including a cash allocation policy to achieve the ROE target of 30% in the final year of the Mid-term management plan by increasing profit growth and capital efficiency, and a policy to accelerate business growth through aggressive growth investments.

We will continue to apply the content of our dialogues with shareholders and investors to our management activities to achieve sustainable growth and enhance our corporate value over the medium to long term.